The other day I was asked whether I was happy that the US President was…

Abandoning the euro would have essentially zero negative income effects for the vast majority of Member States

If you cast your mind back to the peak of the GFC, when people were actually talking about the dissolution of the Economic and Monetary Union (EMU), a.k.a. the Eurozone, or more specifically, a unilateral exit by Greece or Italy, we were told by the ‘experts’ that it would be catastrophic. Over and over, headlines shouted at us how disastrous it would be if the Eurozone failed. Well, guess what, even pro-Euro researchers have come to the conclusion that the effects of collapsing the monetary union would be minimal, to say the least. And when we dig into their analysis a bit deeper, using technical knowledge, the results are even more devastating for the pro-Euro camp. Mostly, using techniques that give pro-Europe narratives the best chance of delivering supportive empirical results, they find mostly impacts that are not statistically different from zero, of an abandonment of the common currency and a return to currency sovereignty for the 20 Member States. I haven’t seen any attention given to this in the mainstream media or from those pro-Euro Tweeters that tweet away with all sorts of nonsense about how good the common currency has been. But then that would be a bridge to far for them I guess.

When Greece was being turned into a colony by the Troika, the general ‘expert’ view was that announcing a unilateral exit rather than accept the ridiculously harsh and anti-democratic bailout package with the accompanying nation-destruction austerity, would plunge the nation into (Source):

… an abyss … a nightmare … chaos … unthinkable anarchy

The journalist who penned that description correctly identified it as “bankers’ drivel”.

Even a former Greek Prime Minister, Antonis Samaras claimed in February 2015, when the talk of Grexit was at fever pitch that (Source):

… living standards could fall by 80% within a few weeks of exit … All of this could push the eurozone into recession.

Tony Blair, who is yet to be tried for crimes against humanity as a result of his part in the illegal invasion of Iraq, claimed in 2011 that (Source):

If the single currency broke up, it would be catastrophic.

At the time, he was reported as continuing to “hold out the possibility that in the ‘very long term’, Britain might still join the euro” – such was the extent of his judgement failure.

I could find a myriad of quotes like that from the commentariat and so-called ‘expert’ economists.

They were happy to see the Greek economy shrink by nearly 30 per cent and see massive public wealth transfers to the elite financiers as part of the austerity-forced privatisations of course.

Real GDP contracted by 26.8 per cent between 2008 and 2016.

By 2022, the contraction was still 20.6 per cent compared to 2007.

In per capita terms, the contraction since 2007 has been 17.6 per cent and since the bailout, modest recovery has been recorded.

So for 14 years, the Greek economy has been held in a state of near collapse anyway.

I wrote about all these issues and provided a blue print for multilateral and unilateral exit for the Member States which would have restored prosperity almost immediately in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015).

The framework set out in that work and the analysis is still apposite.

Nothing much has been changed even with the pandemic and the Ukrainian situation.

Even after it was obvious that the Greek bailout had not delivered the Troika’s promised results and the IMF had been forced to admit that it had got its modelling wrong, there were still ‘experts’ toeing the European Commission line.

I wrote about that the IMF admission in this blog post – The culpability lies elsewhere … always! (January 7, 2013).

The big bankers have continually lobbied against any break given that they are protected by the European Central Bank and making big bucks from the monetary policy initiatives (cheap money, QE rendering capital gains etc) that have kept the Eurozone intact, even with the dysfunctional monetary architecture.

Even in 2019, commentators parading as ‘experts’ were claiming that the “economic consequences and legal controversies would make Italexit practically impossible.” (Source).

Apparently, a “working group comprised of high-level representatives of the Italian government and central bank was asked to study the consequences of an involuntary Italian exit from the euro” concluded that there would be a “severe recessionary ipmact on the economy”.

That is the standard prediction and leads to conclusions like this:

Admitting — unambiguously — that exiting the euro would be disastrous should be the first and most crucial step for whoever aims to lead Italy.

Unambiguously – eh!

Fast track to February 2023

The German ifo Institute for Economic Research, which is based in Munich and is one of the largest ‘think tanks’ in Germany is typically pro-Euro although during the worst of the GFC, its then president, Hans Werner-Sinn argued that the EMU should be reduced in size and allow the Member States that would continue to struggle to “do it outside and depreciate their currencies” (Source).

In its most recent econpol Policy Brief (Number 48, Vol. 7) – Complex Europe: Quantifying the Cost of Disintegration (published February 2023) – the ifo Institute conducts an analysis of the consequences of reversing Europe’s integration process.

They use a technique based on the – Gravity model of trade – to calculate the various stages of disintegration.

The model is a pretty standard technique in international trade studies and essentially forecasts the strength of trade flows based on the respective size of the economic units (in this case Member States) and how far apart they are.

The overriding conclusion is that trade declines as the distance between the units increases and increases in proportion with the size of the nations, which is hardly surprising.

I won’t go into the technical details of how these models are estimated using econometric techniques.

Suffice to say, there are many problems of estimation bias and misspecification that can arise.

Further, most studies end up with a significantly and large ‘unexplained residual’, which means in English that a large portion of the variation in trade flows is not explained by the ‘gravity’ variables.

We should thus be cautious in assessing any conclusions that arise from these studies.

After all, gravity analysis predicted an almost catastrophic collapse of the British economy after the 2016 Referendum, which clearly didn’t happen.

The researchers considered various levels of disintegration of the European project and the estimated consequences for national income generation, production and trade.

So they seek to answer:

… how much lower the growth in trade, production and value would have been if individual steps of the integration had not taken place.

The stages of disintegration are:

1. “collapse of the European Customs Union” – back into WTO allowed tariffs.

2. “Dismantling of the European Single Market” – back to “the introduction of non-tariff trade barriers”.

3. “Dissolution of the Eurozone” – so abandonment of the common currency.

4. “Breakup of the Schengen Agreement” – border controls reimposed.

5. “Undoing all regional free trade agreements (RTAs) between the EU and third countries in force in 2014”.

6. “Complete collapse of all European integration steps”.

7. “Complete EU dissolution and additionally termination of all net fiscal transfer payments between EU members”.

Essentially, they trace the impacts of the ‘disruption’ to intra-EU trade of these stages.

In terms of the “impact on income” they find that:

Real consumption effects differ vastly across countries and integration agreements.

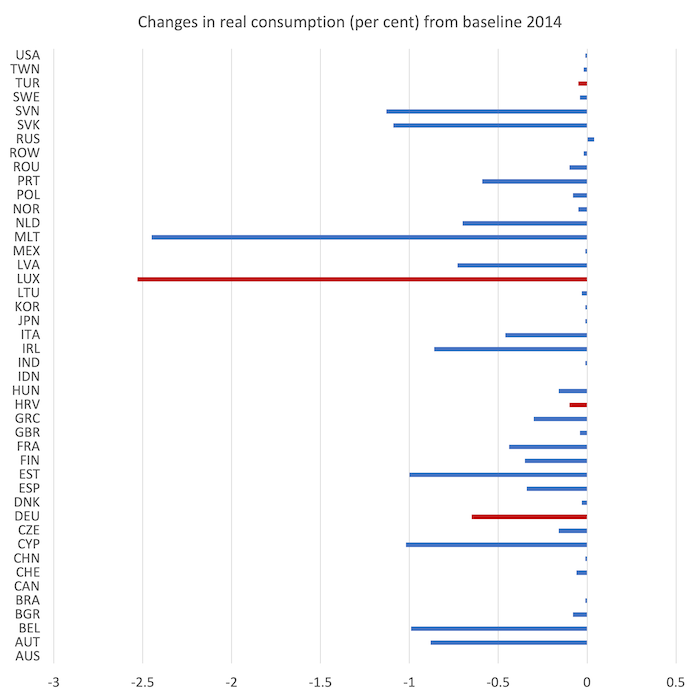

For the abandonment of the Eurozone they conclude:

… we find negative effects for all member states. However, only in the case of Luxembourg (-2.53%) and Germany (-0.7%) are the effects statistically significant … Countries outside Europe are hardly affected.

I will come back to what this means soon.

The following graph used data from their Table 2 – “Changes in real consumption in %, baseline year 2014”.

The red bars denote the results where the statistical significance is at the 10 per cent level (I will explain).

The average effect is only 0.4 points and that is distorted by the estimates for Luxembourg and Malta. If we exclude those nations the average impact i only 0.3 points.

So very small in fact.

But several points should be made.

1. For all but four nations (Germany, Hungary, Luxembourg and Turkey) the results are negative. Why? Because in statistical terms, the rest of the estimates are no different than zero, given they were not found to be statistically significant.

2. Even then, the level of statistical significance that is used is 10 per cent confidence whereas it is more standard to impose a tougher test of significance using the 5 per cent level.

Which nations would have shown up to be significant at that level?

3. Overall, given those points, these results, in as far as we can accept the limitations of the techniques used, reveal that a break up of the Eurozone would have fairly minimal impacts.

Moreover, the gravity model approach gives the conjectures in the study the best chance of getting significant results both in statistical and quantitative terms.

That is, it will give the worst case scenario for the break up of the Eurozone.

The fact that the impacts detected are minor and most not significantly different from zero is a very interesting result that the mainstream media and the technocrats in Brussels will not be advertising very broadly.

We should also note that the simulations are rather biased towards getting large negative results given they do not anticipate any use of the increased domestic policy scope that would come from restoring each nation’s currency.

If a nation just exits the Eurozone and continues to offer the same sort of ‘Brussels approved’ policy options then, of course, the impacts will likely be negative.

But that will come mainly from the policy stance and might be exacerbated to some degree by the increased costs arising from the exit (the so-called transaction costs).

However, if a nation was to exit, restore their own currency, and then pursue a full employment strategy and invest significantly in restoring public infrastructure etc, then I would conclude that the nation will benefit in material terms over time.

Even if the currency depreciated somewhat, that adjustment would be finite and help offset any unit cost differentials between that nation and other stronger export nations.

Of course, initially, it would be likely that the currency would appreciate given that it would be in short supply in the foreign exchange market and remain that way for some time.

Conclusion

There are many problems with this type of analysis.

But the point to remember is that they give pro-Europe narratives the best chance of delivering supportive empirical results.

A technician (such as myself) can see through the limitations, particularly the sparseness of the counter factual (no policy responses using currency sovereignty seem to have been simulated).

But even if we take the results on their face value, their estimates of the damage that abandoning the Eurozone would have on income and real consumption are minimal to say the least and mostly indistinguishable from zero.

Juxtapose that with the official line from the mainstream economists, the IMF, and the European Commission, and you encounter the world of dissonance – hype and hegemonic defence versus reality.

I am still one that considers the only viable future for the 20 Member States is to exit the EMU, restore their own currency sovereignty, and then negotiate inter-governmental agreements at the European level (by abandoning the neoliberal treaties) to deal with matters that can best be handled at the higher than national scale.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

The problem with gravity models is that when you run them to conclusion you end up with singularities – huge over concentrated cities where everybody ends up living on top of each other.

Stars only shine rather than collapse in on themselves because they are generating outward pressure to hold them up.

Same with trade models. They need appropriate fiscal policy before they will shine rather than collapse.

What do we need to do to extend this sort of model into something that is more realistic?

The euro is a failed currency, a postponed corpse, kept “breathing” by artificial means, for 11 years now.

It’s already a disaster and, in one way or the other, it will explode.

The choice will be between an uncontrolled explosion or a programmed demise.

What will happen if (or when) everybody swaps to a new currency?

It’s almost certain that it would be some kind of cripto currency and that will bring other hardships to people (just imagine old people unable to pay for their groceries with bills and coins, or the spying on everything we do).

I ask what will happen because, in the eurozone, all 20 countries have a fixed exchange rate right now.

But what about it when it’s no longer fixed?

Today, the exchange rate of the €euro to the US dollar is 1€=1.0553$US.

And, for example, the old Portuguese escudo (Esc) has a fixed exchange rate of 1€=200.482 Esc.

That means 1$US=189.97Esc or 1Esc=0.005$US.

Just imagine that, tomorrow, it drops to 1Esc=0.002$US.

My income will drop by half overnight.

You could say that the ECB (central banks of the 20 eurozone countries are useless) has the machinery to make it a smooth transition.

It’s a good example that you mentioned Greece.

Greece shows that the EU couldn’t care less for the fate of all of us.

The ECB is the agency that is taking wealth from southern europe to “rebuild” the former sovietic satelites, beeing the once Democratic German Republic the biggest of its recipients.

The europhile politicians and mainstream media neoliberal influencers are a caste that won with the EU, Euro and Neoliberalism, they see themselves as the cosmopolitan winners of globalization, they don’t give a damn about the majority of the population.

Our struggle is not to change the minds of “economists” and neoliberal politicians, our struggle is to elucidate the masses, make them see how they have been harmed by the predatory “elites”.

I agree with your closing remarks but why, even in the worst case scenario of disorderly exit from Euro, would people be forced to resort to cryptos? Cryptocurrencies, as we all know, aren’t suited for transactions and instead are mainly used either for speculations or money laundering. Today’s technology allows a CB to create rather fast and easily digital currency in lieu of physical notes. Varoufakis as finance minister of Greece had developed a parallel payments system, in which tax accounts were linked to one another through the Ministry of Finance database. This way, Greece would have gained enough time to make the transition back to a new drachma. I realise that a Eurozone peripheral country in establishing its own sovereign currency would have to go through an initial stage of sharp depreciation, even up to 50% as in your example, but this would be only temporary and definitely would not last to almost 15 years and counting, as in Greece now, without serious signs of normalcy. Yes, the economic cost of adjustment will be extensive, but if we were to allow it to prohibit us (Greeks) from liberation we would still be under the Ottoman yolk. And let us not forget that when in July 2015 Greeks were ask to decide in a referendum on austerity imposition they rejected it with an astonishing 62%.

My comment refers to Paulo’s remarks.

@Demetrios Gizelis May I commend your comment. But just think of how much more overrun Greece would be with wealthy American and British tourists, until the drachma rose in value.

Patrick, I don’t see any problem with wealthy tourists. They are always welcome as long as the tourism industry can serve them well. A well designed tourism plan could reduce substantially all the negative effects. Likewise, policy restrictions on buying real estate property would save our islands from becoming a mini country of the world’s billionaires, be they Americans, British, or Russian oligarchs.

Demetrios Gizelis: Bills and coins are a legacy of the past and, in due time, they will disapear entirely.

Right now, the US dollar is still the global currency and the US has kept the printer running continously for many years.

That happens because the petrostates recycle their dollars back to the US, buying assets from the US government (bonds) and other private assets.

But there’s a chance that the recycling will end if the saudis accept other currencies to pay for oil (and if the worlds turns to “green” energy, that will happen anyway).

If that happens, the 30 trilions of US debt will come crashing down as inflation.

But, the Fed is already working on the CBDC (central bank digital currency), that has the features of a crypto currency, but legally issued by the central bank (and this one will keep record of its whereabouts, unlike the best known cryptos).

The US dollar will die, paper will be kindled and we will be in another monetary dimension.

The euro is a shadow currency of the US dollar and it will go the same path.

I agree with you, that depreciation will come either way: if we wait for it to crush, or if we leave in a ordely manner.

The crime was commited when the southern countries adhered the half-backed single currency.

It was in the interest of the elites.

They went to the banks and got cheap credit.

It lasted 8 years.

Depending on the status of the borrower, many didn’t even had to hand out any collateral.

And it all bursted in 2008.

The rest is history.

Private defaults were nationalized and the collosal debts of the elites went to the tax payer to pay.

When depreciation comes, we’ll still be paying that debt.

Note: when I say crime, I mean that the 99% of the population is beeing forced to pay the debts of the 1% of the population: that’s theft.

Paulo, I totally agree with you that it’s a matter of time before moving to a paper-and-coin-less currency regime. However, cryptocurrencies are not the same as digital currency, for many reasons which I’m sure you know very well. As for everything else you write I second without any reservation.

Demetrios Gizelis: in a way, all currencies are digital already.

As Bill Mitchell keeps telling us, dollars and euros are all but figures in computers screens.

Some of it is printed for business sake (I could do without physical money, if every shopper had some sort of ATM terminal).

I read somewhere that the Fed’s CBDC will have crypto features and that’s why I brought it up.

Anyway, I believe that there are differences, as you mentioned.

The main difference is about scarcity: cryptos are limited to some predetermined number of “coins”: 21000, I heard (the “new gold”, like the Gorillaz’s new song).

By contrast, dollars and euros are fiat currencies, so there’s no limit to “print”: you just keep adding zeros on the right side of the computer text box.

But the Chinese/Russian bloc is giving signs of a return to the gold standard and that may shift the western’s plans and force to move away from fiat.

Americans left the gold standard back in 1971, when the Vietnam war was draining their gold reserves.

And because the dollar was the global currency (still is), everybody else did the same.

That’s when they started printing big time (I believe that back in 1971, printing was real).

After 50 years of “printing”, something has to give.

In the last 10 years, “printing” has gone crazy.

Those were the QE years (still is in Japan).

Will we see the end of fiat?

Maybe that’s what the WEF calls the “big reset”.

But the reset only works if all players agree to reset at the same time, in the same way.

And that doesn’t seem to be the case.

Another great blogpost, Bill, which I’ve shared with comment on social media.

But I was pleased to see this: “…trade declines as the distance between the units increases”. It confirms what I understood from the man I worked for in 1975 at the time of the 1st European Common Market referendum. He was an economics graduate and persuaded me to vote Leave because he said that if we stayed in ‘production would move to the main market’, which is what your quote says. He was a tory party member and voted Remain, because that was the party line. I believe that the prediction was true in as much as UK manufacturing moved south.

I agree with all of this from an economic point of view. However, I would also like to point out that there are also other important issues, most notably relating to foreign policy and national security, especially now that Russia is openly at war with a sovereign European country. Dismantling the Eurozone or weakening the EU in any other way might not be the best policy right now seen from this perspective. In fact, it might be exactly what Putin is looking for, so I think we should at least be very careful and considerate when making propositions like this.

I would be very interested to hear Bill’s comments on this “wider” political economy perspective.

Jarno, do you really believe that because Greece is in Eurozone and NATO is shielded from Erdogan’s aggression? I don’t think so. And when Turkey in 1974 invaded Cyprus and confiscated 1/3 of the island why didn’t Europe react in the same way as Putin’s invasion to Ukraine?

Jarno,

If you believe a “failed” and “bankrupt” and “incapable” and “crazy” country is an actual imperialist threat, and that a “there’s no money”, we’ll sacrifice every working people for “goals” union is a defense, you should definitely, but openly, defend that deindustrialization, hunger, and poverty in europe are necessities for the hegemony to, for real this time, be interested and successful in human-rights based nation building.

Forgive me for remaining unconvinced of any of these particular points by pathological liars who never cared about their own.

To Demetrios:

I am well aware of the dysfunctionality of the Eurozone and the lack of democracy in the EU. The whole structure was designed to benefit some member countries, while neglecting the interests of others. The answer to your question must be answered on empirical basis, and I am not qualified to do so.

I intentionally left my own question open to different opinions, such as yours.

To Paulo:

if you know MMT, you also know that Russia is not, as yous say, “bankrupt”. It is a monetarily sovereign country (at least to some extent) with a large population and abundant natural resources, combined with a considerable nuclear arsenal. This is why western sanctions have not been very effective in stopping the aggression (with a little help from countries like China and India).

I definitely do believe that the aggression and violence that are happening in Ukraine are real. Go ask the people of Kharkiv or Bucha.

I definitely do not defend austerity or other anti working-class policies in Europe or anywhere else, for that matter.

Jarno,

Of course they are real. But so are the costs, the lies, and the hypocrisies of the other players. The bill is and will be payed by Ukraine first, and Europe second, for, well, hardly believable strategies and goals, while pretending the aggression and violence are the exclusive of the one madman with agency.

Least we should ask is the budget in advance, in money, lives, democratic quality, and so on, for continuous escalation. We should also ask about a lot things “the good guys” do and support for “freedom” and human rights, in this war and others, but that’s outside the scope.